Topic | Collection and Letter of Credit Payment International Trade Payment Methods and Legal Risk Warning

Ren Shanshan from Henan Xianwei Law Firm

Preface

On January 23,2020,the Luoyang Daily reported that the total value of foreign trade imports and exports in Luoyang City in 2019 reached 15.46 billion yuan,of which the total value of import business was 2.13 billion yuan.In terms of trade entities,the total import and export value of private enterprises is 9.77 billion yuan,continuing to be the main driving force for the growth of our city's foreign trade.From the above data,it can be seen that international trade of goods plays a crucial role in our city's market economy.

For Luoyang enterprises planning to expand into the international market,the development of foreign trade business involves many links.In the process of business negotiation and preparation for signing,the payment method to be adopted is a necessary issue to be addressed.The payment methods in international trade of goods are not as simple and flexible as in domestic trade.Both parties to the transaction not only need to consider the security of the incoming and outgoing payments,but also need to consider the different norms and practices in payment settlement.At present,the payment methods in international trade mainly rely on the international conventions compiled by the International Chamber of Commerce for adjustment,such as the Uniform Rules for Documentary Documents and the Uniform Rules for Collections,among which the clear settlement methods mainly include remittance,collection,letter of credit,and international factoring.For enterprises preparing to engage in international trade business,the main payment methods commonly encountered in practice are collection and letter of credit.Below,we will briefly introduce(documentary)collection and(documentary)letter of credit as two payment methods and their potential risks.

一、托收

(一)托收的基本程序

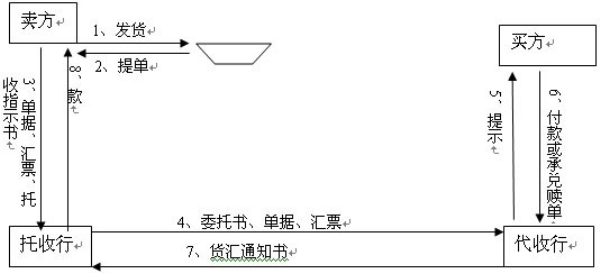

托收是指收款人开立汇票,委托银行向付款人收取货款的支付方式。在国际贸易中,托收的基本程序是,由卖方根据开票金额开立出以买方为付款人的汇票,向出口地银行(托收行)提出托收申请,委托托收行通过它在进口地的代理行或往来银行(代收行),代为向买方收取货款。

跟单托收流程图如下图:

(二)、托收的法律风险及防范

托收这种支付方式下,托收行不管单、不管货、不管票据追索,仅具有“代理收款”的责任,因此托收本质上属于商业信用支付方式。此类支付方式对作为买方来说是货到付款,降低了交易风险,但是对于出口商的卖方来说,收取货款仅仅依靠的是买方的信用,例如在进口国该类货物行情下跌的情况下,进口商拒付或者要求减价导致货款收取受阻。考虑到收付款的安全,实践中跨国交易运用此种付款方式的不多,尤其对于刚刚从事外贸业务的企业而言,这种方式要慎用。但若是小宗货物的买卖,且属于长期合作的商业伙伴且信誉良好、知根知底的客户,出于收款便利的目的,仍可以考虑这种方式。

二、信用证

(一)信用证的基本程序

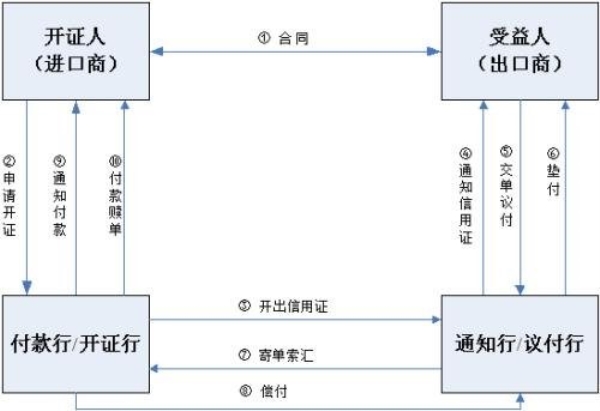

信用证是指银行依开证申请人之请求,开给受益人的一种保证银行在满足信用证要求的条件下承担付款责任的书面凭证。因为信用证所涉及的主体较多,包括开证申请人(买方)、开证行、通知行(也可作为议付行)、受益人(卖方),其具体业务流程如下:

***,国际货物的买卖双方明确约定使用信用证此种方式支付货款,否则买方无开立信用证的义务;

第二,开证申请人,即合同的买方,向其所在地的银行(开证行)提出开证申请,并缴纳开证押金或者提供担保,要求银行向卖方开立信用证;

第三,开证行依照开证申请书的内容开立信用证,并将信用证寄交通知行(卖方所在地银行),将信用证通知卖方;

第四,卖方对信用证审核无误后,即发运货物并取得信用证所要求的全套单据,再依信用证的规定凭单据向指定银行(议付行)结汇;

第五,指定行付款后将汇票和全套单据寄给开证行要求索偿,开证行对单据无误后偿付向受益人付款的指定行;

第六,开证行通知买方付款赎单。

下面是信用证的流程图如下:

(二)信用证的法律风险及防范:

信用证是银行以自身的信誉为卖方提供付款的保证,属于银行信用,相对于托收风险较小。但信用证支付方式却存在信用证欺诈的风险。

信用证欺诈主要是基于信用证的无因性使其独立于买卖合同且银行仅对单据承担责任。主要有以下两种情形:

***,买方欺诈,即开立假信用证或“软条款”信用证。“软条款”信用证是指信用证中规定一些银行付款的***性条款,使开证申请人控制整笔交易,而受益人处于受制他人的被动地位,常见的如信用证中载有暂不生效条款;“信用证项下的付款要在货物清关后才支付”等***性条款。

第二,卖方欺诈,如通常的伪造单据或以假货充真货,如卖方与承运人串通,开立假的货物提单,使货物不存在或者无价值,在议付行提示买方进行付款赎单过程中若不能发现欺诈事实,银行和买方将因此遭受损失。

在发生上述情况下,能补救的措施通常是向法院申请止付令,请求停止付款,但考虑到信用证这种支付方式通常是发生在大额交易业务中,为防范风险,前期的预防就显得越发重要,如订立合同时要做好客户的资信调查,选择资信良好的实力银行进行合作。

律师建议:

实务中选择什么样的支付方式,要与实际情况紧密联系,应根据具体的情况进行选择,如果贸易双方的信用度较高并且有着长期的合作往来,那么汇付、托收这两种对交易信用要求较高的支付方式是可以采用的***佳选择;如果贸易双方是初次合作或者彼此的信用度相对较低,则可以选择信用证或国际保理的支付方式,这两种支付方式能够很大程度的确保贸易双发的资金和财产安全。只有这样才能更好的确保自身的贸易安全,并且能够获得更高的经济效益